single life annuity table

Single Premium Immediate Annuity SPIA Fixed Index Annuities. Besides there are annuity plans which offer flexibility wherein the annuity payouts yearly will.

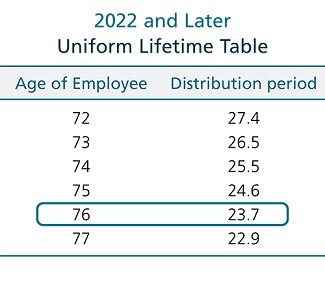

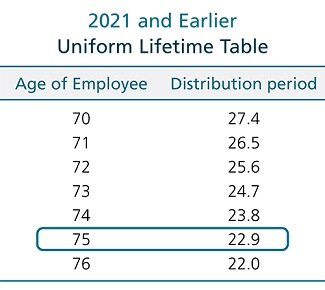

Where Are Those New Rmd Tables For 2022

The table gives maximum guarantee amounts for the two most common forms of annuity.

. Table of Contents Related Articles. A pension plan is a type of retirement plan for which an employer contributes to a workers pool of account funds. The annuity payouts under the second option of joint life annuity include.

Cash value is the money held in your permanent life insurance or cash-valuegenerating annuity. Fixed annuity contracts provide guaranteed retirement income payments. The plan must use reasonable assumptions or factors but does not have to use 417e applicable interest and mortality rates to determine the present value of accrued benefits for any other distributions subject to IRC 417e that are calculated on a lump sum-based formula such as.

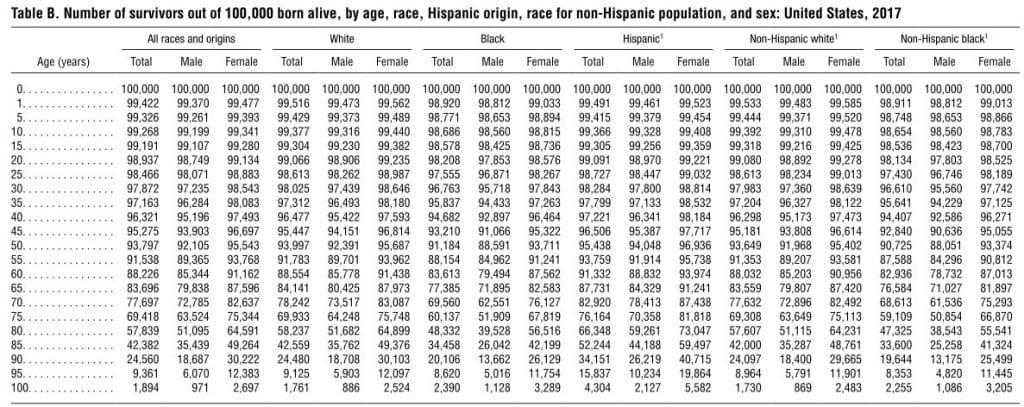

ASingle Life The annuity will be payable in arrears as per payment frequency chosen by you for as long as the annuitant is alive. Actuarial notation is a shorthand method to allow actuaries to record mathematical formulas that deal with interest rates and life tables. Traditional notation uses a halo system where symbols are placed as superscript or subscript before or after the main letter.

Life or Last Survivor with 50 or 100 of the income. It builds when your insurance or annuity provider invests some of your premium in bonds or another. Unlike a deferred annuity an immediate annuity skips the accumulation phase and begins paying out income either immediately or within a year after you have purchased it with a single lump-sum paymentSPIAs are also called immediate payment annuities income annuities and.

The annuity options could vary from single life to a joint life. It depends on the form of annuity in which you receive your benefit. An annuity is an insurance product designed to provide consumers with guaranteed income for life.

An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization. Typically these are offered as structured products that each state approves and regulates in which case they are designed using a mortality table and mainly guaranteed by a life insurerThere are many different varieties of. Methodology being a Top Annuity Company.

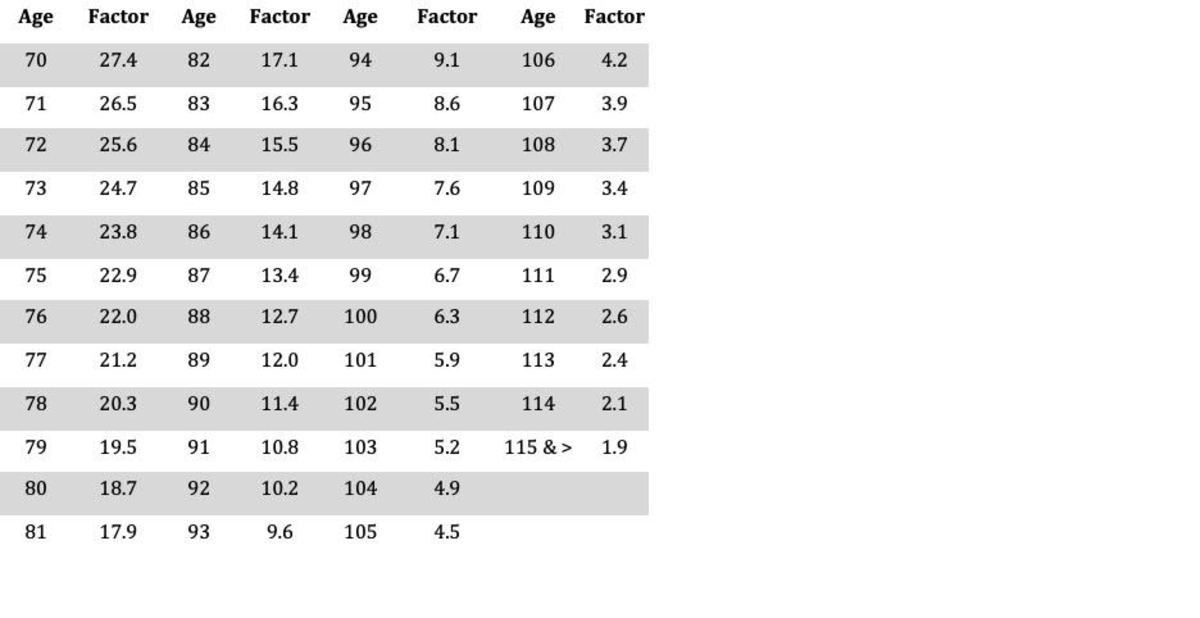

Two life rates are capped at 84 for annuitants above 90 and are graduated downward in a similar way. In the table below are types of annuities based on the features and meeting the requirements by the certain annuitants. More specifically an annuity contract is a legally binding written agreement between you and the insurance company that issues the contract.

The fund is invested on the workers behalf and produces earnings when the worker retires. What are fixed annuities paying. Table of Contents.

Pros Cons. Multi-year guarantee annuity and single premium immediate annuity. On death of the annuitant the annuity payments will cease and no further benefits will be payable.

The policyholder of this SBI pension plan may avail advance annuity payouts in compliance with certain terms and conditions. Reduce the life expectancy by 1. 1 As of May 11 2021.

Remember single premium immediate annuities SPIAs begin paying out within a year of purchase. Single life rates for annuitants between ages 83 and 89 are graduated downward from the rate cap. Thus if we begin by considering whole life insurances with only one possible payment at the end of the year of death then the net single premium is re-written Ax A1 x X k0 vk1 kpx qx.

Straight-life annuity without survivor benefits and joint-and-50 survivor annuity which continues to pay 50 of the benefit to a surviving. Of just a few more columns allows the other main life-annuity and insurance quantities to be recovered with no more than simple arithmetic. Example notation using the halo system can be seen below.

A SPIA is a contract between you and an insurance company designed for income purposes only. The top fixed annuity rates as of June 2022 are 430 for a five-year fixed annuity 430 for a seven-year annuity and 430 for a three-year fixed annuity. Divide the account balance at the end of 2021 by the appropriate life expectancy from Table I Single Life Expectancy in Appendix B.

When pension plan owners retire they can either take the plans value in a lump sum or payments for the rest of the owners life. How Much Does a 100000 Annuity Pay Per Month. Jackson National Life is a trusted annuity leader that offers different annuity types to align with your unique retirement plans.

Immediate Life Annuity Option. This option is available on both single life and joint life basis. 2 The first table of suggested rates in 1927 was based on a residuum target of 70.

In a June 1 2018 press release Venerable Holdings Venerable announced the completion of its acquisition of Voya Financial Incs closed Block Variable Annuity CBVA businessAs announced in December 2017 Voya has divested its CBVA business to Venerable a private company established to serve as a leading industry solution for the consolidation of. 2 As of July 6 2020. Various proposals have been made to adopt a linear system.

In the United States an annuity is a financial product which offers tax-deferred growth and which usually offers benefits such as an income for life. Use the life expectancy listed next to the owners age as of his or her birthday in the year of death. 10-year periodic payments with no life annuity payments after.

June 1 2022. Additional Assumption for Deferred Gift Annuities. Life or Last Survivor with 50 or 100 of the income and Refund of capital.

After I find my age on the table which column applies to me. Talcott Resolution Life and Annuity Insurance Company. Qualified Longevity Annuity Contract.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

The New Year Will Bring New Life Expectancy Tables Ascensus

Federal Register Use Of Actuarial Tables In Valuing Annuities Interests For Life Or Terms Of Years And Remainder Or Reversionary Interests

Federal Register Use Of Actuarial Tables In Valuing Annuities Interests For Life Or Terms Of Years And Remainder Or Reversionary Interests

The New Year Will Bring New Life Expectancy Tables Ascensus

Annuity Mortality Table Single Life Annuities Retirement Planning

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Annuity Mortality Table Single Life Annuities Retirement Planning

Life Expectancy Tables My Annuity Store

Lic Agent Commisssion Chart 2020 Life Insurance Quotes Life Insurance Marketing Ideas Life Insurance Marketing

Federal Register Use Of Actuarial Tables In Valuing Annuities Interests For Life Or Terms Of Years And Remainder Or Reversionary Interests

Pin By Sarah Mae Mann On Beautiful Thoughts In 2022 Words Thoughts Word Search Puzzle

Required Minimum Distributions Required Minimum Distribution Life Insurance Quotes Life Insurance Premium

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More